The Best Cloud Apps for Your Personal Money Management

Everyone knows that they should be doing more to keep track of their spending and to monitor their budget. By creating a smart budget that takes into account all the money you have coming in and going out, you can work out precisely how much money you have to spend at the end of the month and precisely how much you need to save in order to work towards your goals.

But keeping on top of these plans is never easy. How many times have you created an accounting sheet only to forget about it immediately after? Or started keeping a cash book to monitor all outgoings, only to fill in one page before storing it in a drawer never to get it out again?

This is all too common for most of us, simply because it’s so much work to keep an ongoing tally of everything we spend. That’s where mobile comes in though – as with the right mobile apps this can become much more convenient and far more automated. Read on for some great applications that can really help you…

Perhaps the most useful types of apps when it comes to keeping up with your accounting are the note-taking apps. These include applications like Evernote, like Google Keep and like OneNote which allow you to jot down whatever you need to on your phone and then access it from any other web-enabled device on the web.

The reason that Evernote gets our vote here though, is that it supports the most options and the most other applications which make it perfect for creating an effective system.

S-Note

This isn’t a requirement, but if you happen to own a Galaxy Note then S-Note is an including app that’s incredibly handy. That’s because it will allow you to jot things down onto your device using free-hand writing with the stylus and then upload those notes straight to Evernote. There’s no more fumbling around with tiny keyboards then – just write the same way you would with a pen and paper and let your smartphone do the rest.

Google Drive

Google Drive/Google Docs provide you with access to spreadsheets, word documents and a range of other files all stored on the cloud. Again this means you can access them from wherever you are, and the convenience of being able to manage a large spreadsheet on both your phone and your PC is one that you shouldn’t underestimate.

This means that you can create a complex accounting sheet at the comfort of your desk, and then make updates and tweaks to it while on the road using your smartphone.

IFTTT.Com

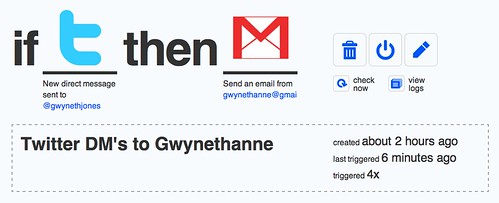

Now IFTTT is not really a mobile app – it’s actually a web app. However this is where the real magic comes in and where you can make the process far more manageable and automated. IFTTT stands for ‘IF This Then That’ and describes the basic concept behind the app – managing automated communication between your various online services using ‘recipes’.

For instance then, an example of a recipe could be a small function that automatically uploads any files you save to your Google Drive straight to Evernote. Alternatively, you could get IFTTT to update a spreadsheet you keep on your Google Drive with notes you write on EverNote, or you could set up a system so that you can e-mail your recent spendings and have them updated on your cash sheet.

What this essentially means is that you no longer have to worry about updating your cashflow because it will all happen for you automatically in the background. Simply take a note of it, and it will be updated on the sheet…

Banking Apps

Of course there will still be times when you forget to update your sheet and you need to add a few expenses at once. In that case then you can try using a banking app in order to check your recent transactions on the fly so that you can update your sheet from your statement.

So there you have it: using mobile and web apps you can create a budget that automatically updates itself for you – so now there’s no excuse for not staying on top of it!

Shruti Vaghe, the author of this post, is a freelance blogger, who often writes for, J Bottom & Associates Ltd., reputable bankruptcy lawyers in New West. She likes to go shopping and spend quality time with her family on weekends. You can also follow her on Twitter @ShrutiVaghe.

Category: Banking, Budget, Financial Planning

Comments (2)

Trackback URL | Comments RSS Feed

Sites That Link to this Post