Credit Score

Credit Score

The Benefits of Checking Your CIBIL Score Online Regularly

A CIBIL score is a three-digit numeric summary of an individual’s credit history. CIBIL full form is Credit Information Bureau (India) Limited and it plays a very important role in the Indian credit system. CIBIL score is used in determining an individual’s creditworthiness. Lenders use this score to evaluate the risk of lending money to […]

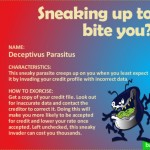

Avoid These Steps If You Want To Have A Good Credit Score

A good credit score of 750 or more is important as it allows you to get quicker and more affordable sanctions on your loan and credit card applications. This is because lenders deem an individual with a good credit score highly credible, who has lower chances of defaulting on a loan. A credit score, to […]

Can Your Credit Record Impact Your Business Loan?

It is said that it’s always better to keep your work and your personal life separate. By that logic, your personal credit history shouldn’t really affect your business loan application. However, often, that isn’t the case. You see, when you are a small business owner, those lines between work and personal life often tend to […]

5 Tips to Quickly Improving Your Credit Score while Preparing for a Loan Application

Countless Americans have less-than-spectacular credit scores. The recent economic downturn, late payments on certain credit items and seasonal layoffs are just some examples of reasons why someone’s credit score may be lower than they would like. The good news is that there are ways to raise your credit score relatively quickly when applying for a […]

Bad Luck With Finances? How to Raise Your Credit Score Naturally

Raising your credit score can lead to more opportunities for loans at lower rates. The credit score is also used for employment, insurance and housing decisions. Consumers must be very careful on how they proceed because the world of credit and debt has its own rules. Bankruptcy Lawyers Omaha NE can help you raise your […]

Follow Us!