Managing Your Personal Finance

Managing your finance include planning, organising, guiding and monitoring your financial activities regularly for a better future. Every individual desires to have a perfect financial plan to reach their financial objectives, but only some could succeed in this process. This article is helpful to people who do not have enough knowledge about financial management or are searching for tips to improve their financial plan. Read this article and be an efficient money manager.

Managing your finance include planning, organising, guiding and monitoring your financial activities regularly for a better future. Every individual desires to have a perfect financial plan to reach their financial objectives, but only some could succeed in this process. This article is helpful to people who do not have enough knowledge about financial management or are searching for tips to improve their financial plan. Read this article and be an efficient money manager.

Budget management

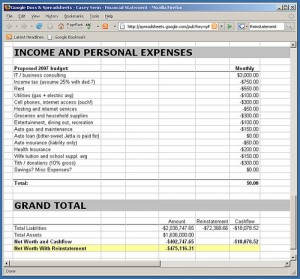

Prepare a budget plan based on your expenses and returns. Update it regularly by noting it on your personal diary, gadgets or notepads. Write everything in your budget plan such as utility bills, grocery bills, credit card bills, telephone bills etc., to have a track of your spending. Check your bank statements and bills to avoid risks due to fraud activities. Assess your budget plan regularly and revise to know your financial status. Pay monthly interests without fail to avoid penalties.

Increase your sources of income

You need to search for other sources of income that increase your monthly expenditure. Some of the sources for your extra income are as follows:

- Search for a part time job, so that you can earn money during your free time. Blogging, article writing, web designing, virtual assistant etc., are some of the part times to earn more.

- Start a small business with little or no investment and strive hard to get more profits.

- Work for over-time in your existing company so that you will be paid more.

Figure out your assets

Make an assessment report of your properties such as cars, houses, commercial buildings, jewellery and other commodities and know its fair market value. Check whether its value is exceeding your debts or lower than it. In this way you can formulate your finances.

Insure everything

Several insurance policies are available in the market such as payment protection insurance, health insurance, life insurance, property insurance and more. Payment protection insurance protects your bank loans and would serve in case of unexpected situations such as unemployment, disability, accident, equipment failure or loss of life where you may not be in a position to pay your monthly EMI. You can contact ppi Claims Company for further details and for any financial emergencies contact payday loan agent. Insurance clients give you all the information related to your eligibility, payment method, payment period etc.

Reduce your spending

Avoid buying unessential things to get rid of debt tangles. Follow simple ways to reduce your spending such as:

- It is better to borrow things which you need temporarily rather than buying.

- Buy in bulk and share with your friends so that you can get them at a considerably low price.

- Buy your groceries at a local retailer to cut your monthly expenses.

- Buy clothes and other accessories during sales or on deals to enjoy the benefits of reduced prices.

Various personal management software’s are available in the market so make use of them according to the trend and manage your finances.

Category: Budget