How to Survive an IRS Audit

IRS Audit

You’ve filled out your tax forms, filed them on time, and now you’re waiting for the dreaded letter from the IRS.

An audit can be intimidating to anyone; after all, it means the IRS is taking a close look at your finances.

But don’t panic—an audit does not necessarily mean you’ve done something wrong or will owe more money.

With a few simple steps, you can survive an IRS audit.

Understand Your Rights During an Audit

It’s important to know what rights you have during an audit. You have the right to remain silent; if there are any questions that make you uncomfortable, seek legal advice before answering them.

Additionally, you have the right to seek assistance from a professional—such as a certified public accountant (CPA) or a tax lawyer—to help you through the process.

A tax lawyer can provide valuable advice on legal matters related to taxes and represent you in court if necessary.

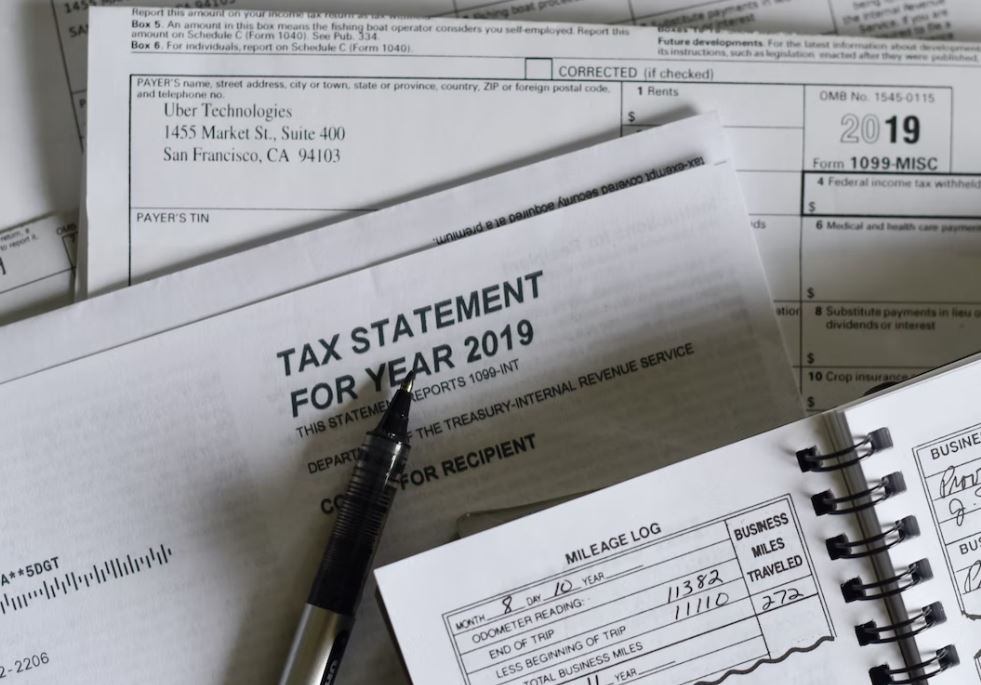

Gather Documents and Records

The next step is to gather documents and records that support your income claims and deductions.

These documents should include bank statements, credit card statements, receipts for purchases or donations made, insurance policies for any losses claimed on taxes, etc.

Make sure all of these documents are organized into neat folders with labels according to their contents so they are easy to find when needed during the audit process.

Be Prepared for Questions

The auditor may ask questions about any discrepancies in your records or why certain expenses were deducted from your taxes.

Be prepared to answer these questions honestly and accurately; if you don’t know the answer, tell them that and request additional time for research before providing it.

Don’t guess or make assumptions—auditors are trained professionals who can easily spot inaccuracies in answers given during an audit process.

Audits can be intimidating, but they don’t have to be overwhelming if you take some basic steps beforehand, such as understanding your rights and gathering relevant documentation and records in advance of the meeting with the auditor.

Additionally, enlisting help from a tax lawyer can provide invaluable advice on how best to proceed with an audit so that it goes smoothly and efficiently for everyone involved.

Taking these steps will ensure that if faced with an IRS audit, you’ll know exactly what must be done to survive it!

Category: Taxes