Financial Problems and Priorities Impact on Your Credit History

Credit Cards are available to anyone upon reaching 18 years of age. The companies have a much stricter criterion for providing cards and a credit limit than they had prior to the recession but there is still a tendency for Americans to want credit and for credit card companies to provide it. Consumer debt is on the rise again after the recession began to recede.

Credit Cards are available to anyone upon reaching 18 years of age. The companies have a much stricter criterion for providing cards and a credit limit than they had prior to the recession but there is still a tendency for Americans to want credit and for credit card companies to provide it. Consumer debt is on the rise again after the recession began to recede.

The figures are published by the New York Federal Reserve and they are rising. The problem with increasing debt is the ability to repay it. Those in regular employment that provides the income to meet their financial obligations are fine but whenever anyone in debt loses their job the problems start.

Consumer Reports: How credit history affects car insurance

Medical

Some debt is more urgent and others; it is time for choices and the priorities are likely to be the ones that can cause the greatest damage to a personal credit score which is a reflection of the content in their credit history. Few people have an emergency fund. It means that medical bills which are almost inevitably unexpected are difficult to manage.

Figures relieve that 60% of bankruptcies in 2013 were the result of medical bills. Those bills are usually one-off and a default will only result in a single entry on a person’s credit history. The entry appears at the default stage and finally paying the bill will have no impact on the history until the bill is ‘timed-out.’ That takes seven years.

Student Debt

Student debt is more important. Defaults will have an impact on credit history and lenders can actually get an enforcement order whereby payments are deducted at source; a figure is deducted as part of the employer’s payroll process. There are however various ways where student loan repayments can be deferred on a temporary basis.

Student debt is more important. Defaults will have an impact on credit history and lenders can actually get an enforcement order whereby payments are deducted at source; a figure is deducted as part of the employer’s payroll process. There are however various ways where student loan repayments can be deferred on a temporary basis.

They include a situation where the debtor is only working part time, is back in education full time or simply unemployed. Interest will accrue but at least it is possible to get breathing space.

Installments

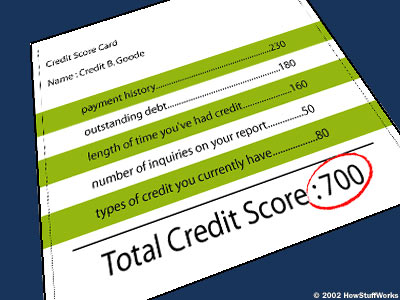

The real issues that can impact on credit history are the regular payments including installment loans, the minimum payments that credit card companies require each month and of course mortgage payments where applicable. It is possible that missing a single credit card payment can be the difference between being approved or otherwise for a future loan or even a mortgage.

You may be determined to maintain as good a credit score as possible. If you can keep up to date with all your financial liabilities you will do that but at what cost? It makes far more sense to try to reduce the number of creditors you have and there is a way to do that even if you have let your credit score slip.

Some financial institutions have undoubtedly become far more conservative in their holiday realistic loans lending and a good credit score is one of the most important requirements they have to approve any loan.

Online Lenders

In contrast there are online lenders that are taking a different stance on lending. They are placing far more reliance on affordability than history. If an applicant is realistic in his or her application then as long as there is regular monthly income and the repayments look affordable there is every likelihood that an application will be approved.

This online sector is becoming increasingly popular with the added benefit to the applicant that every time an installment of the new loan is paid on time, their credit history benefits. A medical bill is a single entry; every default on an installment payment goes into a credit history and also stays for seven years.

Bay woman tries to help others keep their credit in check

Credit History

It is clear that a credit card can be expensive and particularly dangerous when it comes to your credit score. It surely makes sense to use the facility of an online lender that is sympathetic to employed applicants because not all debt is equal. There may be occasions when you have some difficult financial decisions to make, choices between differing liabilities when it is impossible to pay them all.

All other things being equal then you should prioritize those that have the biggest impact on your credit score via your credit history. Online lenders may be able to help you along the way.

Category: Debt