11 Killer Tips to Save Money and Live on a Budget

If you want to save money, you got to live on a budget. There is no getting round this fact. But mind you, living on a budget, doesn’t mean tightening your belt so much, that you can’t breathe. You can have a great and satisfactory life even if you cut down on your expenses. Don’t sacrifice your comfort, but take steps to plan your finances and stabilize them. You need to plan for the future and plan for emergencies and this is only possible if you save money.

So, without wasting any more time, let’s take a look at 11 tips that will make sure you keep fattening your wallet:

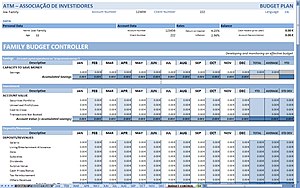

1. Plan your Spending

In other words, you need to work out a monthly budget. You can go about this in two ways a) Say you are earning $2000 every month. Set aside $500 as your monthly savings and make sure that you limit your expenses to $1500, b) You can list out your monthly expenses and set aside an amount that covers these expenses; the rest you can save.

2. Make Bulk Purchases

Think about making bulk purchase as far as household items are concerned, especially those items that have a long shelf life. You will get big discounts on bulk purchases, which will help you save a lot of money.

3. Customer Rewards Programs and Coupons

Sign up for all free customer rewards programs whenever you come across them. Get cards and use them and if you are eligible for discount coupons get them, and use them too. Also keep collecting those coupons in newspapers and at the back of cartons that make you eligible for free gifts. A free gift that has practical use means you don’t have to spend money to buy that particular product, which is money saved.

4. Don’t get influenced by TV Commercials

You will be surprised that many of our buying decisions are influenced by all those TV commercials we see. So, stop getting influenced by TV and make informed decisions about what you want to buy and why you want to buy a particular product. If you get influenced by all those commercials, you will end up buying things you don’t need.

5. Take your Office lunch from home

Precious money can be saved, if you cook lunch at home and take it to your office. Don’t waste money eating out when at work. What’s more, it will take a toll on your health if you do so.

6. Buy Discounted Clothing

Don’t spend a lot on clothes; hunt for shops that stock up on discounted, yet quality clothing and buy from there. There are plenty of stores selling low cost high quality clothing, just find them and buy from them. Something else you can do isbuy clothes online. Some of the best deals on clothes are available online.

7. Don’t go to Expensive Restaurants

Family outings to restaurants must be restricted to those places that are not very expensive. This means the ‘fine dining’ restaurants are out of the picture, and even if you do visit such places make sure to keep these visits to a bare minimum. Before you visit a restaurant, make sure that you have a restaurant budget in mind. Don’t’ go above and beyond this budget.

8. Play the Waiting Game Before you Purchase

If you want to purchase something, apart from groceries, don’t take an immediate decision. Wait for some time and see if you can do without buying that particular product. If you can make do without it, that’s money saved; if you can’t, then you probably need it.

9. The Monthly House Raid

Remember, that bulk purchase, you made a few months ago, when you visited WalMart? Do you know whether you have used everything, or there is something that is still left unused? Big question, isn’t it? So, raid your house every month, go through your closet, the attic, the kitchen shelves and every other storage space used to store household items. Such raids have the potential to unearth some forgotten goodies. It will save you from buying these products again. You will be amazed to find a list of products that you never knew were lying around your house.

10. Switch off Lights when Not in Use

I see houses being lit like a Christmas tree, even when there is nobody home, in these houses. Remember, you need to pay for power consumption and any indiscriminate use means your electricity bills will go up. This is something that will dent your savings; so make it a point to switch off the lights when you are not using them. Even when you are at home, make sure that you switch off the lights in those rooms that you are not using at that particular point of time.

If you do this, you will quickly find your electricity bills going down, which will lead to substantial savings on this front.

11. Focus on Reliability and Durability

Irrespective of the fact whether you are buying electrical appliances, electronic devices, clothes, shoes or something else, focus on their reliability and durability. Don’t buy cheap products that can give out on you at any time. Investing in reliability makes sure that you get returns on your investment for a long time to come. This helps you save money in the long run. Buying a cheap product that doesn’t make any claims to reliability might give you an immediate cash benefit, but in the long run, such choices will be an expensive bargain.

End Words

That’s not it by a long way. You need to do a whole lot more than just follow these few tips to save money and live a budget life. Some people are under the impression that living on a budget means they have to sacrifice the good things in life. That’s not true at all. Think of a budget as something that helps you live within your means and not take on expenses that you cannot afford. If you think of the process of saving money as something that absolutely needs to be undergone, you will have absolutely no problems with it.

Author Bio:

Gianna Clark is an expert on money saving tips for families and has helped plenty of families sort out their budget and increase their savings. She is associated with WomenSavings, a website that offers financial advice to women looking for tips to live on a budget. In her spare time, she loves catching up on the latest movies.

Category: Budget, Family Finances