Tag: Credit history

Money Saving Tips When Purchasing a Car Title Loan

Car title loan is mainly referred to a loan provided by any reputed title loan company by cash. In this type of loan, the aforesaid company puts their lien on the vehicle for which they have offered the loan until it is being paid off completely. It is advantageous as you can get the cash […]

Bad Credit Report? Five Tips to Get Back On Track with Finances

You just got your credit report back, and it’s not looking good. Before you can qualify for a mortgage, afford a car loan, or be free of debt, you’ll need to get your finances in order. Here are 5 tips to getting your finances back on track. Pay Bills on Time The first step to […]

Some Ways to Get a Cheaper Loan

There are some moments when you simply have to bite the bullet and accept that you need to borrow some money through a loan. This isn’t something that we ever want to do, because of the fact that there interest to be paid back on it every single month. Having said that, if you’re going […]

Time To Choose The Best Repair Credit Company Among The Lot

If you start browsing through the internet, you might come across thousands of companies of the same field related with bad credit repairing service. However, in case you are a novice in this field, it might be a risky situation for you to choose the best among so many options available. During such instances, you […]

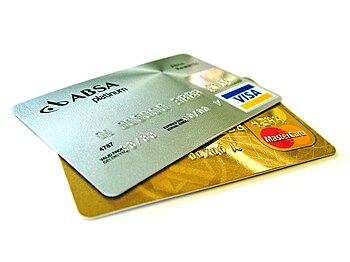

Credit Cards: The Pros And Cons Of Using Plastic For Everyday Purchases

Most people make small purchases every day, like a cup of coffee or a lunch while at work, not to mention groceries and other everyday needs. There are several possible to ways to pay for everyday expenses, including credit cards. Using credit cards for everyday purchases has several pros and cons you should be aware […]

Are Title Loans the Right Solution For Your Money Problems?

If money is tight, a title loan may be for you. With a title loan, you can use your automobile as collateral. Unlike traditional loans, a title loan can be easily secured. In some cases, your credit will not be considered. This makes a title loan a great alternative with those with less than perfect […]

Thinking of Buying a Home? 4 Things Lenders Consider

If you’re thinking about buying a new home, contacting your local realtor through REMAX-Georgia.com is a great way to see what’s available in your area and start pricing homes. While you’re shopping for a new home, remember the following four things lenders consider: Debt-to-income ratio. Known as DTI, your debt-to-income ratio is calculated by dividing […]

Follow Us!