Tag: Credit card debt

Take a Look at a Balance Transfer Credit Card to Consolidate all of your Credit Card Debt and Save Money

Now that the holidays are over you may be looking at some pretty hefty balances on your credit card statements. And if you are one of the people that took advantage of store branded credit cards then you might also be looking at paying a decent amount of interest as well. But what if […]

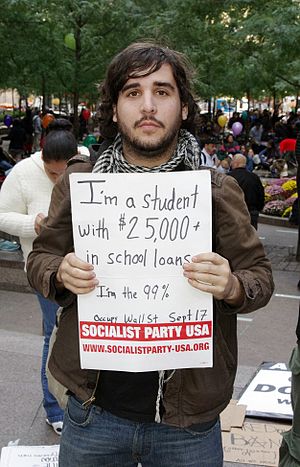

6 Financial Tips for People Repaying Student Loans

With college behind you, it may feel like you’re ready to take on the world. However, without the right financial knowledge, you may find yourself in over your head when it comes to your finances. Here are six financial tips to help you become a financially independent student loan repayer. Create a Budget To prevent […]

Tips for Staying on Top of Your Debt

A course that should be mandatory for all high school and college students should be one that deals with personal finance and debt management. People think about debt management in terms of businesses and the rate of borrowing and lending that takes place in the economy, but they do not necessarily connect these concepts to […]

Struggling With Debt? This is Your Action Plan to Get Back On Track

Living with debt is something you can’t really appreciate until it happens to you. Sure, no one likes the sounds of debt and we all know it’s something we’d rather avoid if possible. What you may not be aware of though is just how big an impact being in debt can have on your life […]

Don’t Use Bankruptcy as a Way to Fix Your Debt Problems

Imagine never having to worry about debt problems again no matter how deep in the hole you have been! There is always a solution available if you are willing to look past the bankruptcy industry that has many people believing that they have no option other than giving up all of their rights and assets. […]

Want To Save Money On Your Credit Card Debts? Here’s How!

These days, credit card debt has become a way of life for many. More people have balances on credit cards today than ever before. Another staggering statistic is that most people spend too much money on their credit card debts! The truth is, there are tons of people out there that qualify for lower interest […]

How to Tighten Your Financial Strings

Whether you’re living alone or raising a family, you will find that for the same budget, the number of items on your grocery cart seems to be getting smaller and smaller. Apart from inflation, it could also have something to do with economic problems which prevent average-earning individuals from progressing financially. You are definitely lucky […]

3 Financial Sins to Avoid in 2013

2013 is likely to be another tough year for the economy which means as individuals we need to try even harder to stay on top of our finances. I’ve come up with 3 deadly financial sins to avoid at all costs throughout 2013: 1. Using Short Term Finance to Pay off Christmas Christmas has been […]

How Balance Transfer Credit Cards Can Save You A Small Fortune

Whether you’re an experienced cardholder or a credit novice, odds are at one time or another you’ve payed some interest on your credit card. It happens to the best of us, and one or two interest payments isn’t such a big deal if you keep your balance low. However, if you realize that month after […]

Follow Us!