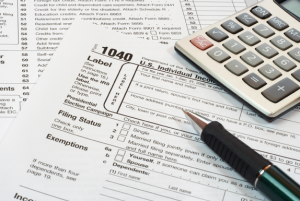

Taxes

Taxes

Tax Season: How to Avoid an Audit This Year

Nothing sends shivers up the spine more than a tax audit. Although only 1 percent of returns are audited in a given year, there are ways that you can reduce your odds of hearing from the government even further. What are some things that you can do to avoid a tax audit? Don’t File a […]

Tax Accountants Help You Pay Reduced Amounts to the IRS

In a recent poll of tax accountants, they were asked what was the main concern or worry that their clients had. The results of the poll were clear. They were most worried about their taxes increasing every year. Do you believe this too? I think we all do. But these clients are taking the most […]

5 Tax Credits That People Don’t Think About When Filing Their Returns

Preparing and filing an income tax return can be stressful, especially if you aren’t sure what expenses you can get tax credits for. There are statistics out there that state that there are millions of dollars left on the table in unclaimed tax benefits for a variety of different reasons. Make sure you’re getting back […]

Lower Your Utility Bill and Increase Your Tax Refund: 4 Great Tips

Homeowners who care about going green will be happy to know that tax credits for energy efficient home improvements are still in place. When you make the right choices for your renovations, you can watch your utility bill drop while maximizing your refund in the spring. Here are four smart ways to achieve the best […]

5 Ways To Know You Need Help With Filing Your Taxes

It is not so simple to file taxes. While some small business owners will use a simple program, they are getting the short end of the stick. In fact, when unprepared, a person is more likely to overpay or get audited. That comes with a burden of forms, paperwork, and maybe even fines that you […]

Tax Avoidance Vs Tax Evasion

The only similarity between tax avoidance and tax evasion is that they are both known to be activities of tax noncompliance. Tax avoidance is where one either doesn’t pay specific taxes because they don’t believe in their government’s activities such as their support and /or involvement in war or their right to avoid paying too […]

Top Tax Tips for Veterans

When you found out you could file a 1040, the same form civilians typically fill out, you were probably relieved. But then you sat down with the form and realized that, in addition to the gratitude of a grateful nation, you were also rewarded for your service with really complicated taxes. This is no 1040 […]

Six Things You don’t want to Forget to Include in your Annual Tax Return

Tax time is quickly approaching, and it’s important to get your paperwork in order long before the April 15th deadline. Make sure that you have all the receipts you need in one place now so that you aren’t scrambling to find it when you are filling out the forms. Filling out the forms as accurately […]

Five Ways You Can Save Money When Filing Your Taxes

A taxpayer should try to find multiple ways to lower his or her tax burden so that he or she can enjoy a better return. Now, most people use the basics and get to deduct a few small expenses. However, to get a decent return and not overpay on taxes, one should follow these five […]

Follow Us!