Simple Ways You Can Help Your Family Get Out Of Debt And Start Saving

The US Census Bureau states that the average American household was $70,000 in debt in 2011. While a large portion of that is usually a mortgage, the average outstanding debt for credit cards, medical bills, car notes and student loans still stood at $7,000. If you want to get your family out of debt and start saving for the future, here are some strategies that can get you on the road to financial freedom.

Pare Down or Eliminate Monthly Charges

Gather all of your bank and credit card statements, then go over them with a fine-toothed comb. Look for all of your recurring monthly charges and think about ways to reduce or eliminate them. For example, some households may be paying for cable service and Netflix when only one of the two is actually used.

Others may notice they are paying far too much for the convenience of monthly payments. Car insurance and yearly subscriptions may be cheaper if you pay all at once. Use the money saved to pay down debt.

Minimize Your Possessions

When it comes time to get serious about debt and financial freedom, it might also be a good time to streamline your possessions and eliminate clutter. Consider selling unused or out-of-date electronics and media. Pare down your wardrobe and sell the excess at a consignment shop. Sell off books you don’t plan to read again and small cooking appliances you haven’t touched in years. Not only will the sale of thee items help you dig out of debt, this process will also allow you to live a life without clutter.

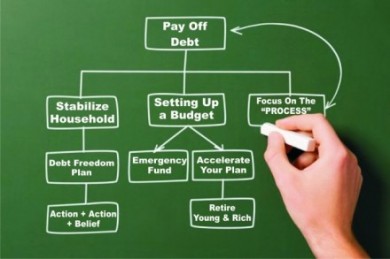

Draw Up a New Budget

In order to get out of debt, you have to know where your money is being spent. You can use free online programs to help you track your spending, or you can use a sheet of paper. Consider how much you want to spend each month on restaurant meals and coffees, new clothes and other discretionary spending.

In order to get out of debt, you have to know where your money is being spent. You can use free online programs to help you track your spending, or you can use a sheet of paper. Consider how much you want to spend each month on restaurant meals and coffees, new clothes and other discretionary spending.

Track your gas purchases or other transportation expenses such as a bus pass, subway tokens or taxi rides. Look for ways to spend less on each item. While some spending will likely be non-negotiable, other areas of your budget are entirely within your control and can be slimmed down considerably.

Consider Opening a Side Business

Multi-Level Marketing can be a great option for increasing your income. For example, you may decide to become a representative of a company such as ASEA. Not only will your own sales net you a profit, but you will also receive a potion of sales from others you get into the business, known as your down-stream. This can set you up with a handsome side income.

Check out Asea reviews for more information. Other options for side businesses include artistic ventures, such as selling your artwork or doing freelance writing work. If you enjoy manual labor, such as gardening, painting walls or hanging drywall, a cottage industry business may be more your speed. Look around for opportunities that match your strengths and skills.

Negotiate Your Debts

Once you have some cash saved up for an emergency fund, you will likely want to become more aggressive with paying down your debts. In many situations, you may have the power to negotiate.

For example, if you owe $5,000 on a credit card, you may be able to call he company and negotiate a lower interest rate or even a better rewards program. Asking will cost you nothing but your time, and a positive response could end up saving you hundreds or even thousands of dollars.

Get Out of Debt

Getting your family out of debt can be a rewarding experience. Becoming financially free will open you up to opportunities and stress-free living you may have only imagined in the past. By using these strategies, you can get your family on the road to being debt-free and having fewer financial responsibilities.

Category: Debt

Comments (1)

Trackback URL | Comments RSS Feed

Sites That Link to this Post