Billpay Wiz: 4 Top Ways to Cover Your Payment Bases

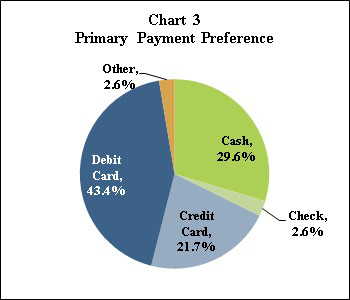

Today, consumers have multiple methods to use when paying for goods and services. Although some companies have eliminated the use of some of these types of services, the majority of businesses still allow customers to make payments using cash, check, debit cards or credit cards.

Today, consumers have multiple methods to use when paying for goods and services. Although some companies have eliminated the use of some of these types of services, the majority of businesses still allow customers to make payments using cash, check, debit cards or credit cards.

Each of these payment types have their own advantages and disadvantages, so before choosing one method or the other to make a payment or purchase an item, it is important to understand which type of payment is best for the transaction.

Credit Cards

One popular method of paying for goods and services is with credit cards. They provide convenience as there is no need to carry cash or checks. In addition, when you pay with a credit card, you have the option of paying for your purchase over time rather than immediately. As a business, accepting credit cards means almost instant payment with little risk of the payment being cancelled later.

The Cashless Society — Contemplating The Ultimate Surrender To Government …

However, businesses also pay fees in order to accept credit cards. Most cards charge between three and five percent on purchases made with credit cards. For some small businesses, this may be excessive, so it is important to discuss the fees with the credit card company in an effort to keep them reasonable.

In addition, when accepting credit cards, it is important to verify the identity of the person using the card to avoid accepting a fraudulent card. For consumers, credit cards provide convenience as they can pay for the purchase over time, which is beneficial when making large purchases.

However, according to Creditcards.com, the average credit card debt per adult in the United States is $4,878 and approximately three percent of consumers default on that debt. Therefore, if you plan to use credit cards for purchases, it is important to have an understanding of your ability to pay before undertaking the debt.

Checks

Although fewer people use checks today, they still offer advantages over other forms of payment. For businesses, there are no fees involved in accepting checks, although many companies use check verification services that come with monthly fees. For consumers, checks are sometimes safer than credit cards because most businesses require significant identification before they will accept a check.

However, some businesses have stopped accepting checks because they can be more difficult to collect than credit card payments. If you use a check and do not have enough money in your bank account to pay for it when it is presented to your bank, it can be sent back to the merchant.

This can cost you additional bank fees as well as added charges from the merchant who must then collect the unpaid check. Regardless whether you buy personal checks by mail or in person, be sure that your account has sufficient funds to pay the check when it is presented.

Cash

There are no fees to businesses who accept cash as payment and the risk of fraud on the business end is extremely low. The biggest disadvantage to cash is the risk involved in carrying large sums of cash or having a significant amount of cash on hand in your business.

The risk of robbery when a company is known to have large sums of cash is much higher than for businesses whose form of payment is either check or credit card. For consumers, it is easier to misplace cash and some people find that they are quicker to spend money if they carry cash than if they use a credit card or check.

Debit Cards

Although they are very similar to credit cards, debit cards have different advantages and disadvantages. Consumers who are concerned about increasing their debt prefer to use debit cards as the money is drawn directly out of their checking or savings account, eliminating finance charges or the possibility of overextending themselves.

Although they are very similar to credit cards, debit cards have different advantages and disadvantages. Consumers who are concerned about increasing their debt prefer to use debit cards as the money is drawn directly out of their checking or savings account, eliminating finance charges or the possibility of overextending themselves.

Some banks charge a fee to the consumer for using a debit card at a point-of-sale terminal while others charge the merchant for accepting them.

The Cashless Society – Contemplating The Ultimate …

The biggest disadvantage to debit cards is that you run the risk of severe financial problems if the card is ever lost or stolen. In addition, it is possible to overdraw your account using a debit card as the money is withdrawn directly from your account if you do not track your balance closely.

Some banks do not have strict fraud protections on debit cards as they do on credit cards. This means that you could be responsible for as much as $500 should a thief use your debit card.

These common forms of payment for goods and services are the easiest and best ways to make purchases. Because each method has its own advantages and disadvantages, it is important to determine which method works best for your circumstances.

Category: Uncategorized