4 Steps to Claim a Mis-sold PPI

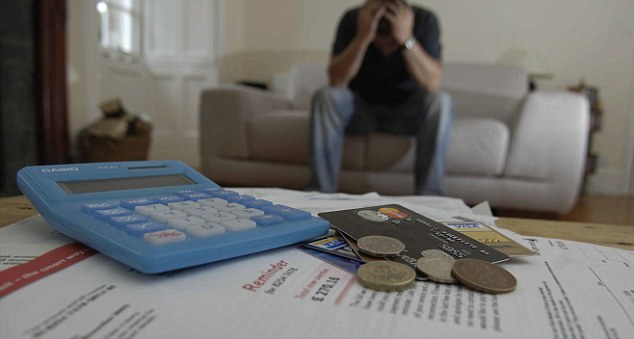

Payment protection insurance was designed to help people, who for different reasons cannot keep up with their monthly payments. Although this product is supposed to come as a breath of fresh air for those who have refund problems, it has been mis-sold to millions of people bringing them even more trouble.

If you are one of the people who were mis-sold a PPI, here is what you should do to claim it:

Find out if You have PPI

There are two ways to find out if you have payment protection insurance. First, you can check your credit card statements to see if there have been monthly payments for it. As you read your statements, look for terms like loan repayment insurance, loan protection, payment cover, account cover, or ASU insurance. These are some other names of PPI.

Second, call the bank or the finance company that rented you money and ask if your loan came with this insurance.

Find out if Your PPI was Mis-sold

The most common cases when PPI was mis-sold include:

- Your were not told that PPI is optional

- You were not told that the policy will be added to your loan

- You were pressurized to accept it

- You were advised to accept it, although it was not something you wanted

- If you were not told that your PPI cover would end before you fully refunded your loan.

Talk to Your Lender

If you discover that your payment protection insurance was mis-sold, or you decide it does not fit your current situation, you should talk to your lender first. All you have to do is write him a letter (you can find templates on the internet) in which you explain your situation and furnish all the information you have on your loan protection. Make sure you do not miss any detail if you want the bank to make right assessment for your situation.

After submitting the letter, the bank or the finance company should get back to you with an answer in 6-8 weeks. There had been cases when they asked for another 6 – 8 weeks in order to make a complete assessment. If this is your case, you can either wait for another 6 weeks or send your complaint to the financial services department.

Make the Claim

When it comes to making the claim for payment protection insurance, you have two options such as you can make the claim yourself, or you can hire a company to do it for you. If you do not have the time to deal with it, there are many claim handler companies who can do all the necessary paperwork for you.

If you have the time and the motivation needed, consider filling in the paperwork yourself. All you have to do is to fill in a free PPI claim form and submit it to the financial services section. You should not have to pay up to 30% of your protection insurance just because you were a little lazy.

There are companies that pursue customers aggressively to convince them to hire their services to claim their mis-sold protection cover. Before hiring any of these companies, think about the amount of money you are going to lose on them.

Author Bio:

Alisa Martin is into consultation profession involving loans and insurances for long and she helps you better in making your PPI claims. To discover more about the tips and tricks, you can visit his websites and niche blogs over the web.