2015 is Halfway Over – Are You on Top of Your Debt?

Every year millions of American vow to resolve their debt and gain better control of their financial futures. Statistics show that credit card debt in 2015 averages to approximately $15,000 per household.

Every year millions of American vow to resolve their debt and gain better control of their financial futures. Statistics show that credit card debt in 2015 averages to approximately $15,000 per household.

Where on the scale do you compare? Now that we are halfway through with 2015, where do you stand in regards to paying down your debt?

Many people hit a plateau regarding their finances or experience a setback that undoes all the hard work that’s been put in over the previous months.

There are ways to keep on top of debt even if unexpected expenses have made the goal seem harder. It’s the routine of good financial habits that make them work in the long run. There will always be ebbs and flows, but understanding how to ride out the low times is how to maintain financial control.

Tackling your debt is an ongoing effort, but seeing the amount owed shrink month-to-month is the much needed boost to keep anyone motivated.

How to Trick Yourself Into Paying Off Your Credit Card Debt

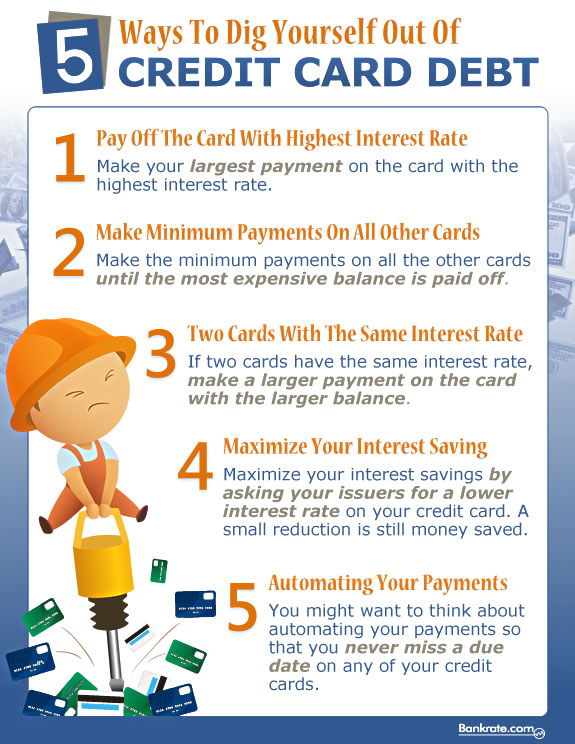

For those who may need a jumpstart to their efforts, here are four things to keep in mind:

Those who want to eliminate their debt need to focus on which area to concentrate on first. Bad debt, such as credit cards or personal loans, is the first area to tackle. These types of debt usually come with higher interest rates and takes more time to pay back. In the meantime, those in debt may begin to accrue late fees or rack up interest rates that exceed the monthly minimum they’re paying. Always make at least the monthly payments and don’t add on to debt by opening a new line of credit or seeking a loan. Creating a budget that allows for more money to be allocated to paying off bad debts is helpful. This doesn’t mean taking away from monthly payments needed for other necessary expenses. It just means that any extra should be put towards paying down this type of debt first. Also, if there is a surge of income from a bonus, raise, or even a monetary gift, these can also be applied to getting rid of the debt and the interest charges it brings with it.

Those who want to eliminate their debt need to focus on which area to concentrate on first. Bad debt, such as credit cards or personal loans, is the first area to tackle. These types of debt usually come with higher interest rates and takes more time to pay back. In the meantime, those in debt may begin to accrue late fees or rack up interest rates that exceed the monthly minimum they’re paying. Always make at least the monthly payments and don’t add on to debt by opening a new line of credit or seeking a loan. Creating a budget that allows for more money to be allocated to paying off bad debts is helpful. This doesn’t mean taking away from monthly payments needed for other necessary expenses. It just means that any extra should be put towards paying down this type of debt first. Also, if there is a surge of income from a bonus, raise, or even a monetary gift, these can also be applied to getting rid of the debt and the interest charges it brings with it.

- Consider financial achievements over personal victories. It may be smarter financially to apply a bigger payment to a bigger debt. However, if that same payment would pay off a smaller debt altogether, then the psychology of having “one less thing” off your debt list may be worth it. Compare options and figure out what provides the most financial advantage, but also what makes it seem personally rewarding.

- Take a look at spending over the months. Are there any areas that need closer attention? Has the budget changed in any way? Are there new ways to apply bigger payments to certain debts. A month-to-month budget is great, but it’s always a good idea to reevaluate every few months to review any changes. Summer months and weeks leading up to the holidays are notorious spending times, and there might be a noticeable rise in spending that requires extra attention before it gets out of hand.

- Take care of relieving tax debts as soon as possible. Owing money to the IRS can feel overwhelming, but there are ways to pay off your tax debts without falling too far from your financial plan. A tax debt relief company can assist in IRS negotiations and payment plans to help alleviate this extra financial stress and put an action plan in place. Avoidance is the worst thing when it comes to making payments on owed taxes. Face the issue head-on and work it into your budget.

Do Balance Transfers Hurt Your Credit Score?

Make sure you celebrate the wins! Managing debt and staying on top of finances is a huge accomplishment. Consider each milestone, each debt crossed off as a goal achieved. Of course, the reward doesn’t have to be anything that costs a lot of money, but a small treat makes the victory seem that much sweeter. Also, if one of the goals is to save for a bigger purchase like an extended vacation or a new home, then visualizing how far into the goal you are is a great way to “see” that victory is near.

Which financial goals have you achieved so far? Which ones are left to complete in 2015? Share your progress on your continued success!

Category: Debt